Infant Care Fees

| Breakdown Of Payment (9% GST Inclusive) | Working Mother | Non Working Mother | Permanent Residents / Foreigners |

|---|---|---|---|

| Monthly Fees (After Basic Subsidy Deduction) | $826.81 | $1,276.81 | $1,426.81 |

| Registration Fees | $54.50 | ||

| Deposit | $1,309 | ||

| Annual Insurance | $3.27 | ||

| Romper | $13.08 | ||

| Mattress Cover | $10.90 | ||

Playgroup Fees

| Breakdown Of Payment (9% GST Inclusive) | Working Mother | Non Working Mother | Permanent Residents / Foreigners |

|---|---|---|---|

| Monthly Fees (After Basic Subsidy Deduction) | $495.43 | $645.43 | $795.43 |

| Registration Fees | $54.50 | ||

| Deposit | $729.75 | ||

| Annual Insurance | $3.27 | ||

| Uniform | $21.80 | ||

| Mattress | $32.70 | ||

| Mattress Cover | $10.90 | ||

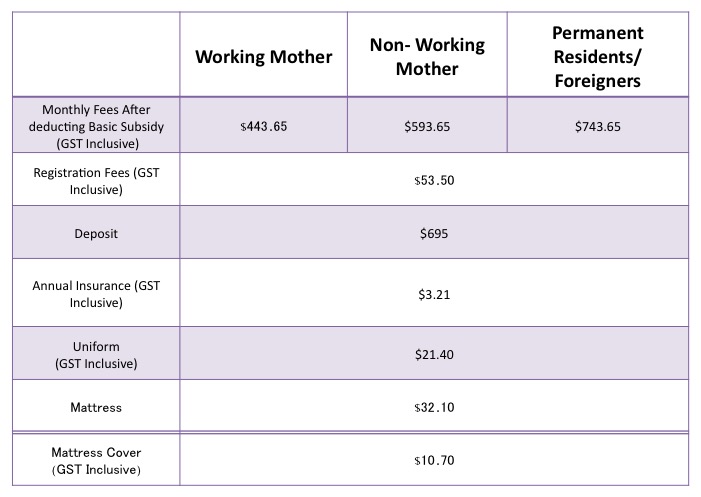

N1 – K2 Fees

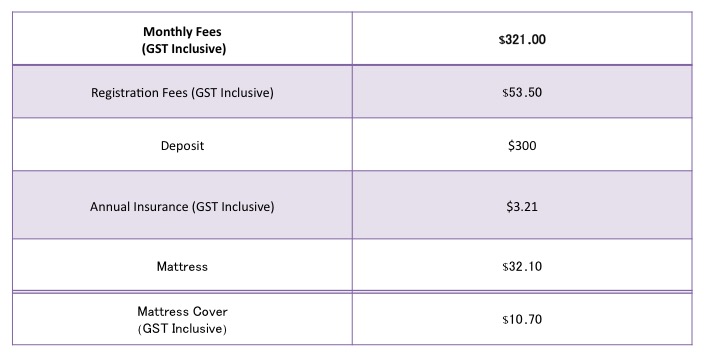

Student Care Fees

CHILDCARE/INFANT CARE SUBSIDIES

All parents with Singapore Citizen children enrolled in child care centres licensed by ECDA are eligible for a Basic Subsidy.

For Infant care , a basic subsidy of $600 is given to working mothers/single fathers who work a minimum of 56 hours per month and a subsidy of $150 for non-working mothers/single fathers.

For Child care, a basic subsidy of $300 is given to working mothers/single fathers who work a minimum of 56 hours per month and a subsidy of $150 for non-working mothers/single fathers.

| BASIC SUBSIDY | INFANT | CHILDCARE (Playgroup – Kindergarten 2) |

|---|---|---|

|

WORKING mother/single father: $600 NON-WORKING |

WORKING mother/single father: $300 NON-WORKING |

In addition, families with monthly household income of $12,000 and below are now eligible for an Additional Subsidy, with lower income families receiving more.

Larger families with many dependants can also choose to have their Additional Subsidy computed on a Per Capita Income (PCI) basis.

For more information on Infant & Childcare Subsidies https://www.ecda.gov.sg/parents/subsidies-financial-assistance